If you are filing your GST return annually, you probably chose this option to reduce your administrative overhead. But did you know that you might still need to send in quarterly payments? Making your required payments on time can save you hundreds or thousands of dollars in interest.

Do I need to pay GST/HST instalments?

You need to pay GST/HST instalments in 2022 if:

- You file your GST/HST return annually (as opposed to quarterly or monthly)

- Your net tax (line 109 of your GST/HST return) for 2021 was $3,000 or more. Note that this threshold could be lower if 2021 were the first year you filed a GST/HST return.

Why do I need to pay GST/HST instalments?

Canada Revenue Agency wants to collect GST/HST as quickly as possible. The quarterly instalment payment system is their way of collecting the tax sooner without forcing businesses to file more frequently.

When are GST/HST instalment payments due?

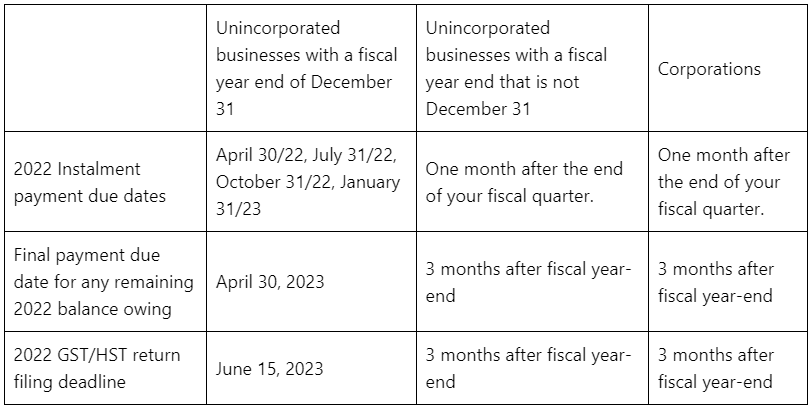

Your due dates depend on what type of business you have:

Most individuals with unincorporated (self-employed) business income have a fiscal year that ends on December 31, so due dates would be in the first column above. Occasionally, an unincorporated (self-employed) business will have a different yearend (not December 31), putting their due dates in the middle column above. Corporate due dates are in the last column.

As an example for columns 2 and 3, if your business year end is July 31, your quarters would end on October 31, January 31, April 30, and July 31. Instalment payments would then be due November 30, February 28, May 31, and August 31. Any remaining balance owing for your July 31, 2022, fiscal year would be due October 31, 2022 – the exact date your GST/HST return is due.

If any of the above dates fall on a Saturday, Sunday, or holiday recognized by CRA, the due date moves to the next business day.

How much do I need to pay for each GST/HST instalment?

Option 1 – Based on the prior year

This option works well if your GST/HST balance owing is likely to be the same or higher in 2022 than in 2021. With this option, each instalment payment equals ¼ of the prior year’s GST/HST net tax (line 109 of the GST/HST return). So, if your net tax were $10,000 for 2021, your quarterly instalments for 2022 would be $2,500 each (10,000/4). With this option, you shouldn’t be charged interest if you pay the calculated amounts and the remaining balance by the due dates indicated in the table above.

Option 2 – Based on the current year

This option might work better if your GST/HST collected has declined significantly from last year. With this option, you use an estimate of this year’s GST/HST owing to remit your instalments. The downside of this option is that if your instalments are too low, CRA will charge you interest on the difference.

What happens if I do not pay GST/HST instalments?

If you do not pay instalments when required to, you will be charged interest.

What happens if I have a balance of GST/HST payable?

If you use Option 1 (based on the prior year) to calculate your instalment payments and pay any remaining balance owing by the due date, CRA should not charge you interest on your instalments. If you use Option 2 (based on the current year) and have a balance owing, you will be charged interest.

How is GST/HST instalment interest calculated?

Interest is calculated based on CRA’s prescribed rate, which changes every 3 months. The current prescribed rate (for the last quarter of 2022) is 7% for overdue GST/HST instalments. The rates for the first 3 quarters of this year were 5%, 5%, and 6%, respectively. So, if you have an unincorporated business with a December 31 yearend, and you missed your April 30, 2022 instalment payment entirely, you would be charged 5% interest from April 30-June 30, 6% interest from July-October, 7% from October-December and the 2023 rates are for Jan-April 2023. As of May 1, 2023, interest will be charged on your unpaid GST/HST balance owing for 2022.

If you paid less than any required instalment, interest would be charged on the difference. For example, if the calculated GST/HST instalment payment amount was $2,500 for April 30, 2022, and you paid $1,500 on that date, you would be charged interest on $1,000.

Depending on changes to the prescribed interest rate, you can reduce or possibly eliminate this interest charge by making future instalment payments early. So, if you realize on June 15th that you haven’t made your April 30th instalment payment, you could pay April and July together to reduce the interest that you would otherwise be charged on your April 30th payment.

If you realize in January that you should have made instalments for the previous year, you can make a lump sum payment to reduce future interest charges.

Contact McCay Duff LLP in Ottawa for advice and assistance with tax planning and preparation matters.

Contact the tax professionals at McCay Duff LLP in Ottawa to discuss how partnering with us can help with your GST/HST instalments. Our tax advisors provide expertise in all aspects of corporate tax, Canadian and U.S. personal tax and ensure compliance with tax laws while minimizing your tax obligations. To learn more about how McCay Duff LLP can assist you or your business, please get in touch with us online, by telephone at 613-236-2367, or toll-free at 1-800-267-6551.