The Government of Canada has implemented the Canadian Dental Care Plan to provide dental coverage for uninsured Canadians with an adjusted family net income of less than $90,000.00.

Accordingly, effective for the 2023 tax year issuers of T4 and T4A’s must report on the tax slips whether, on December 31st of the taxation year a payee or any of their family members are eligible to access dental insurance coverage of any kind, including health spending and wellness accounts. This reporting is mandatory beginning in the 2023 tax year and will continue to be required on an annual basis. Failing to report this information may result in financial penalties and the Canada Revenue Agency (CRA) may reject any T4 or T4A slip that is filed without this information.

Thus, employers should ensure that their payroll systems or payroll providers are set up to include this information for the 2023 reporting period.

New reporting requirements for T4s

The new reporting box on the 2023 T4 Slip is Box 45 and you must select one of the following:

- Not eligible to access any dental care insurance or coverage of dental service of any kind

- Coverage/ access for payee only

- Coverage/ access for payee, spouse and dependent children

- Coverage/ access for payee and their spouse

- Coverage/ access for payee and their dependent children

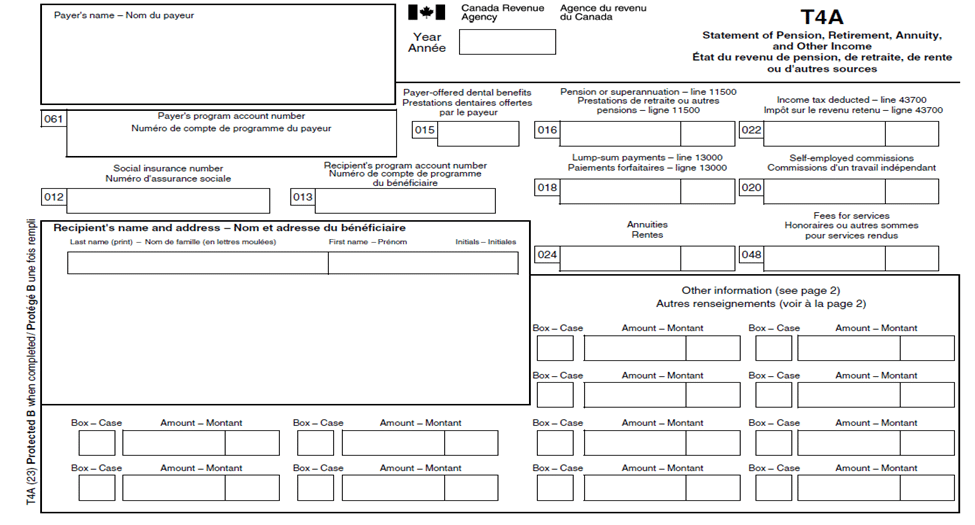

New reporting requirements for T4As

The new reporting box on the 2023 T4A Slip is Box 015 is mandatory if an amount is reported in Box 016, Pensions and Superannuation otherwise the box is optional. If completing box 015 you must select one of the following:

- Not eligible to access any dental care insurance or coverage of dental service of any kind

- Coverage/ access for payee only

- Coverage/ access for payee, spouse and dependent children

- Coverage/ access for payee and their spouse

- Coverage/ access for payee and their dependent children

Contact McCay Duff LLP in Ottawa for Advice on The Canadian Dental Care Plan

At McCay Duff LLP, our trusted tax advisory team can help you determine which deductions and tax credits are available to you and your family. In addition, if you have questions regarding the Canada Dental Care Plan and the T4/T4A reporting requirements for employers, our experienced accountants are here to help clients in Ottawa and across Ontario. To learn more about how we can help you and your business, contact us online or by telephone at 613-236-2367