What does this mean for small business owners?

A new compilation standard, section 4200, Compilation Engagements, has been released by the Auditing and Assurance Standards Board. The new standards are effective for periods ending on or after December 14, 2021, with early adoption permitted. These new standards replace the old Notice to Reader section 9200 which was released over 30 years ago and needed to be updated to reflect the current needs of users of financial information.

Previously, Notice to Reader financial statements was prepared with the intention that they were for the use of management only and were not going to be used by external third parties. Today, that is not always the case, and the new standards allow for the financial statements to be issued with the intention that they could be used by a third party such as a bank. The new standards reflect that there was often a misunderstanding among users about the extent of the work performed by accountants and did not provide any information on the basis of accounting that was used in the preparation of the statements.

With the new standards, there will be some additional work required by accountants at the beginning of the engagement. Part of the additional work will include discussions with management with the intention of getting a better understanding of their client’s businesses. These will include obtaining information on operations, the accounting system and records and any third parties that could rely on the financial statements. These discussions will also include any significant judgements (allowance for doubtful accounts as an example) that the practitioner may have assisted management with so that management accepts responsibility for those judgements and understands their impact on the financial information contained in the statements.

Prior to accepting the engagement, accountants will also have to enquire of management as to who the intended users of the financials will be and have them acknowledge that the third parties have agreed to the basis of accounting expected to be applied during the preparation of the financial information. The understanding that the financial statements would be used by a third party includes management acknowledgment that the third party would be in a position to request additional information on the financial information included in the statements.

As mentioned above, since no information was previously provided on the basis of accounting, financial statements will now be required to have a note that describes the basis of accounting used in the preparation of the compiled financial information. The purpose of the description of the basis of accounting is to provide users who are not familiar with the business a better understanding of how the financial information is put together. Some of the more common examples of the basis of accounting are:

- a cash basis of accounting

- a cash basis of accounting with selected accruals and accounting estimates

- a basis of accounting as prescribed by a contract or agreement

While many accountants will help clients determine what the basis of accounting is, it is still ultimately the responsibility of management, and they will have to confirm the basis of accounting in the form of either written communication or an oral discussion with their accountants during the year-end preparation.

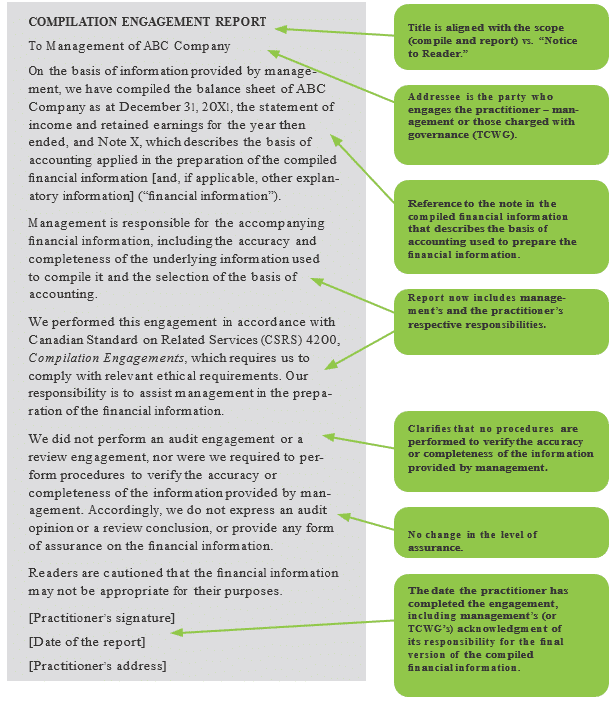

Another new component of the new standards is both a new engagement letter and compilation report. The engagement letter, which would be sent to the client before the start of the engagement, will include not only the scope and objective of the engagement but also details on the intended use of the financials, the responsibilities of both the practitioner and management and other required acknowledgements under the new standard when the financials are intended to be used by third parties. As with the engagement letter, the new compilation report will expand on both the responsibilities of management and those of the practitioner. As well, the new report will explain the limitations of a compilation engagement so that it is clear to users that these types of engagements do not provide assurance on the financial statements and information provided by management. Below is an example of what the new compilation engagement report will look like.

If you have any questions or wish to discuss the impacts of these changes on your business, please reach out to your McCay Duff advisor. Our team is highly skilled and serve the local Ottawa and surrounding business community with professionalism and a dedication to excellent service. To speak with one of our knowledgeable advisors please contact us online, or by telephone at 613-236-2367 or toll-free at 1-800-267-6551