New Business Support Programs

Deputy Prime Minister and Finance Minister Chrystia Freeland announced on October 21, 2021, that new COVID-19 programs will be put in place to replace the Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy.

The Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy both expired on October 23, 2021.

Two new versions of the rent and wage subsidies are being proposed to provide targeted relief to the tourism and hospitality industry and those businesses that have been the hardest hit by the pandemic. The two new versions of the rent and wage subsidies are the Tourism and Hospitality Recovery Program and the Hardest-Hit Business Recovery Program.

Tourism and Hospitality Recovery Program

The Tourism and Hospitality Recovery Program will provide wage and rent subsidies to organizations in selected sectors of the tourism and hospitality industry that have been deeply affected since the outset of the pandemic and that continue to struggle.

Examples of eligible organizations in the tourism and hospitality industry include hotels, restaurants, bars, festivals, travel agencies, tour operators, convention centres, convention and trade show organizers, and others. Additional details on the definition of qualifying businesses within this category will be forthcoming.

How do you qualify?

Eligible organizations would be required to meet the following two conditions to qualify for this program:

- An average monthly revenue reduction of at least 40 percent over the first 13 qualifying periods for the Canada Emergency Wage Subsidy (12-month revenue decline); and

- A current-month revenue loss of at least 40 percent.

The 12-month revenue decline would be calculated as the average of all revenue decline percentages for eligible organizations from March 2020 to February 2021. Any periods in which an entity was not carrying on its ordinary operations for reasons other than a public health restriction (for example, because it is a seasonal business) would be excluded from this calculation. The existing rules would continue to apply to calculate the current-month revenue decline.

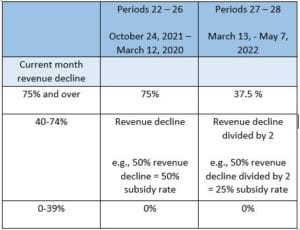

Subsidy Rate Structure

The maximum subsidy rate for the wage and rent subsidies would be set at 75 percent from October 24, 2021, to March 12, 2022.

The rent and subsidy rates would be reduced by half from March 13 to May 7, 2022.

Lockdown Support would be available at the current fixed rate of 25 percent and pro-rated based on the number of days a particular location was affected by a lockdown, as under existing rules.

The table below, details the proposed wage and rent subsidy rate structure for organizations that qualify for the Tourism and Hospitality Recovery Program from October 24, 2021, until May 7, 2022.

Hardest-Hit Business Recovery Program

The Hardest-Hit Business Recovery Program will provide wage and rent subsidies to organizations that do not qualify for the Tourism and Hospitality Recovery Program and have been adversely impacted since the beginning of the pandemic.

How do you qualify?

Businesses will qualify for the program if they meet the following two eligibility requirements:

- An average monthly revenue reduction of at least 50 percent over the first 13 qualifying periods for the Canada Emergency Wage Subsidy (12-month revenue decline); and

- A current-month revenue loss of at least 50 percent.

The calculation of the 12-month revenue decline would follow the same rules as under the Tourism and Hospitality Recovery Program, as detailed above. The existing rules would continue to apply to calculate the current-month revenue decline.

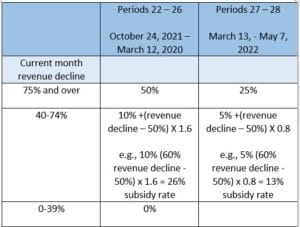

Subsidy Rate Structure

Under this program, the maximum subsidy rate for the wage and rent subsidies would be set at 50 percent for eligible entities from October 24, 2021, to March 12, 2022.

The wage and rent subsidy rates would continue to be calculated based on current-month revenue.

The rent and subsidy rates would be reduced by half from March 13 to May 7, 2022.

Lockdown Support would be available at the current fixed rate of 25 percent and pro-rated based on the number of days a particular location was affected by a lockdown, as under existing rules.

The table below, details the proposed wage and rent subsidy rate structure for organizations that qualify for the Hardest-Hit Business Recovery Program from October 24, 2021, until May 7, 2022.

What Happens in the event of a Public Health Lockdown?

Businesses subject to a qualifying public health restriction would be eligible for support at the subsidy rates as calculated in the Tourism and Hospitality Recovery Program, regardless of sector, if they have one or more locations subject to a public health restriction (lasting for at least seven days in the current claim period) that requires them to cease activities that accounted for at least approximately 25 percent of total revenues of the employer during the prior reference period.

Applicants would not need to demonstrate the 12-month revenue decline, only a current-month decline. It would be available to affected organizations, regardless of sector.

Canada Recovery Hiring Program

The Canada Recovery Hiring Program is set to expire on November 20, 2021. The government is proposing to use its authority to update the subsidy rate to 50% for the October 24, to November 20, 2021 period. In addition, the government is proposing to introduce legislation to extend the hiring program at the new rate of 50% until May 7, 2020, with the authority for a further extension to July 2, 2022.

The existing eligibility rules would also continue to apply, including the required revenue decline of more than 10%.

New Individual Support Program

The Canada Recovery Benefit ended on October 23, 2021. To ensure that workers continue to have support the government is proposing to extend the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit until May 7, 2022, and increase the maximum duration of benefits by 2 weeks. This would extend the caregiving benefit from 42 to 44 weeks and the sickness benefit from 4 to 6 weeks.

Canada Worker Lockdown Benefit

The government plans to introduce regulations to create the Canada Worker Lockdown Benefit to provide $300 a week to workers who are subject to a lockdown, including those ineligible for employment insurance. The program will be available until May 7, with retroactive applications starting on October 24, 2021.

Contact McCay Duff LLP in Ottawa for guidance on any of the latest COVID-19 Support Measures.

To enjoy the benefits of having experienced business advisors on your side, contact McCay Duff LLP by reaching out online, or by telephone at 613-236-2367 or toll-free at 1-800-267-6551.