The Canada Revenue Agency (CRA) has released the PD27 10% Temporary Wage Subsidy Self-Identification Form for Employers. Eligible employers are required to indicate on the form the amount of Temporary Wage Subsidy (TWS) claimed as a reduction of their payroll remittances for the period March 18 to June 19, 2020.

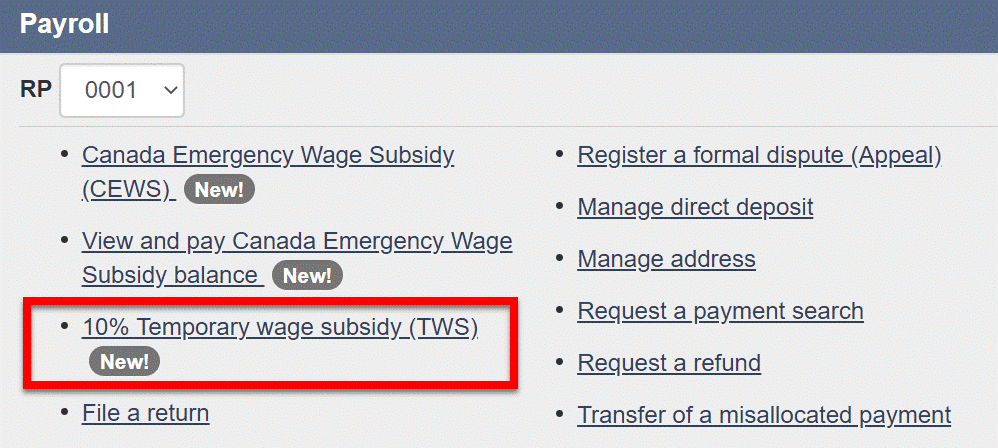

The CRA has confirmed employers who are eligible for the 10% Temporary Wage Subsidy are required to complete and file a self-identification form demonstrating their eligibility for the program. The form can be submitted either through the payroll section of the My Business Account (see screenshot below), or by completing form PD27 and mailing it to your National Verification and Collections Centre (addresses are listed on the PD27 form).

Eligible employers who did not reduce their remittances and want to receive the TWS must complete and submit the PD27 form to enable the CRA to credit their payroll program account by the amount of the subsidy they are eligible for.

Eligible employers who do not wish to claim any TWS and only claim the CEWS or who wish to claim a lower percentage are still required to file the PD27 form indicating the lower percentage claimed. It will be important for employers who are also claiming a Canada Emergency Wage Subsidy (CEWS) to indicate the lower percentage claimed, if applicable, as failing to do so may result in the entire 10% being credited and a corresponding reduction or recovery of their CEWS claim.

Information on how to complete and submit the PD27 form can be found on the Government of Canada website.

For more information on filing the PD27 form contact your McCay Duff advisor.