I recently had the opportunity to attend a Webinar hosted by the American Society of Appraisers (ASA) that discussed the impact COVID-19 is having on business valuations. The panelists included ASA’s, ABV’s, CBV’s and CFA’s and one of the most discussed topics was the impact the valuation date can have on business valuations, due to the uncertainty caused by the COVID-19 crisis.

How is the valuation date determined for Family Law?

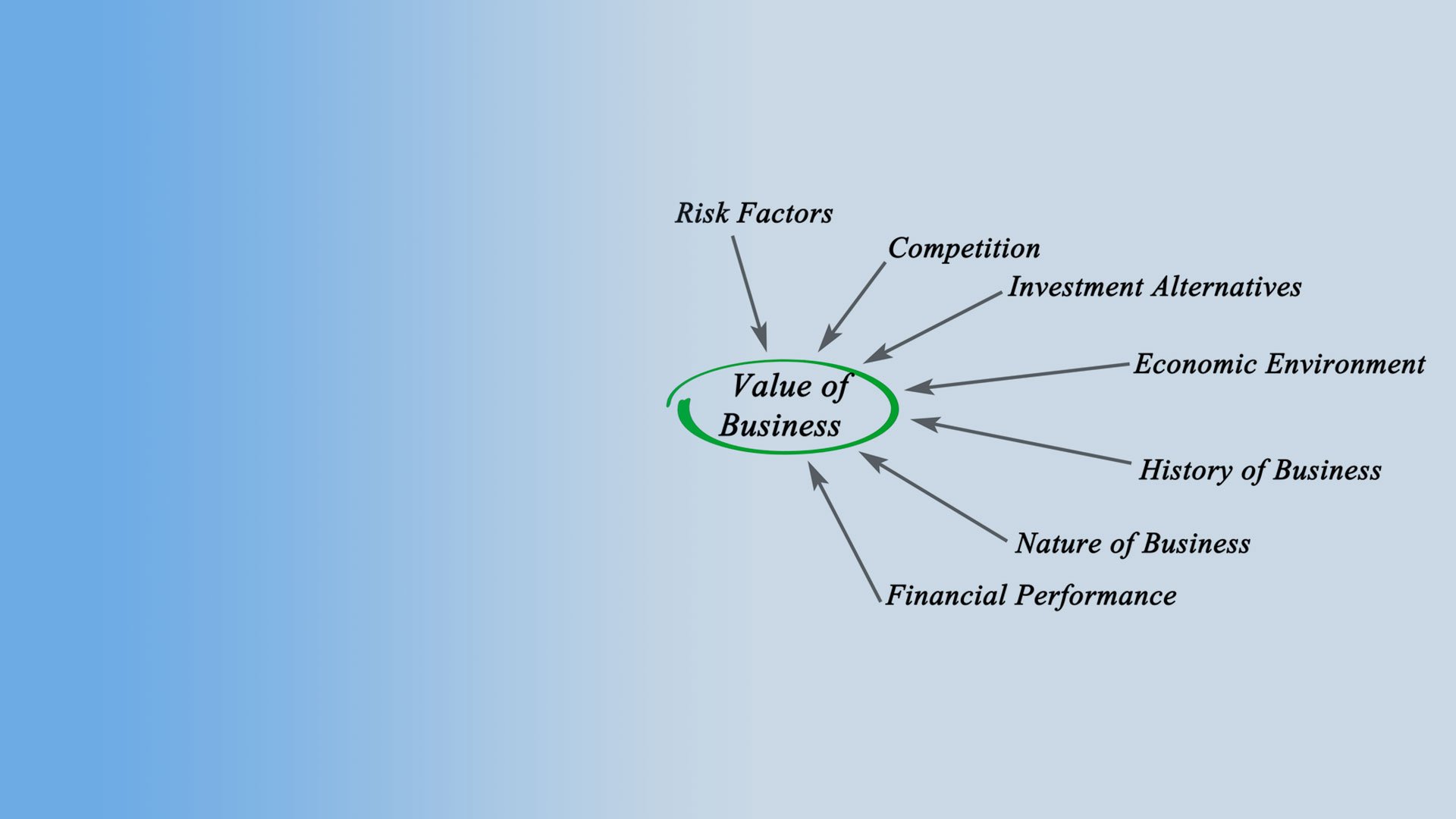

The underlying concept of fair market value (“FMV”) is that value is determined at a point in time. The valuation process is complex and has a number of variable factors that determine FMV. However, when a valuation is being performed for certain purposes, such as for family law, the valuation date is not variable and is dictated by the courts.

For example, the valuation date for family law purposes is usually the date of separation. Why is this such an important issue when talking about COVID – 19? As mentioned, FMV is determined at a point in time. When we determine value, our valuation standards say we can only consider information and facts that were “known or knowable” at the valuation date. So, the question is, at what point in time did COVID -19 become known or knowable?

If the valuation date is December 31, 2019, it can be agreed that we could not have anticipated the impact of COVID-19. Toward the end of February, we were starting to see the impact that COVID-19 was having on the markets and by mid-March we were seeing a huge impact on the markets. It would certainly seem reasonable to fully take the impact of the crisis into account by March 11, 2020 when the World Health Organization announced there was a global pandemic.

This means that the value of a business interest as of December 30, 2019 will likely be very different than a value determined as of April 1, 2020.

What if a spouse’s ability to fund a settlement has changed due to COVID-19?

This causes concern because it may have a huge impact in family law cases. A legitimate value as December 15, 2019 may have been determined, however, the ability of the spouse to actually fund the settlement may be devastating to their personal financial position. It would be fair to include a subsequent event discussion in the valuation report to indirectly deal with the impact of the crisis on FMV.

The Courts are currently closed but at some point, they will have to consider these timing implications and the resulting potential inequities caused by this crisis.

The impact of COVID-19 on fair market value is not going to be the same for all companies.

Some companies will see their value drop significantly for at least the next year or two while others will maintain their value. The COVID – 19 crisis should not be used as an automatic reason to reduce the fair market value of a business. Instead, a careful analysis of the impact of COVID – 19 on the subject company should be performed.

If you need further information, reach our to Rick at revans@mccayduff.com.

Contact Us