You and your business are two separate entities. When building a business, it is important to build a reputation for the business and its own goodwill and credit. While goodwill can bring loyalty from customers and suppliers, good business credit can bring affordable finance. This process will take time, but it is worth the effort while you build a company that can outlive you.

How Business Credit Works

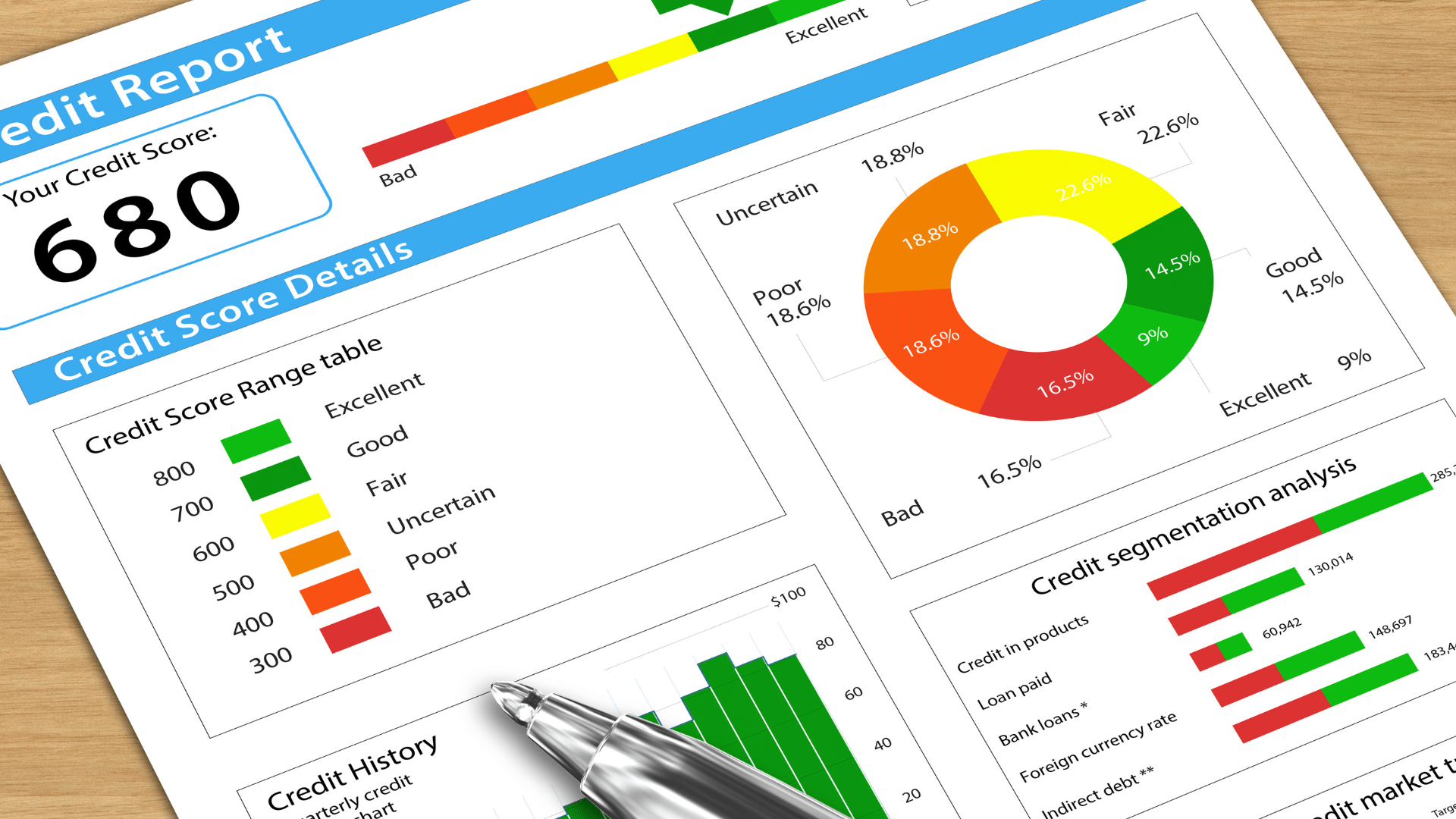

Like your personal credit score, your business credit score ranges between 300 and 900 and is calculated based on your payment history lenders and vendors report to commercial credit agencies. Your business credit score tells the credibility of your business based on which investors, financial organizations, landlords, suppliers, and other businesses can determine what terms to offer. A good score can get you favourable lease terms and increase your chances of getting higher loans and others forms of business financing on your favourable terms.

However, a business credit score differs from a personal credit score in two ways. Firstly, anyone can buy your credit report. Secondly, not all lenders report to credit agencies, making it difficult to build business credit.

Five Ways Entrepreneurs Can Build Business Credit

The best way to build business credit report is to make timely payments and get noticed by credit bureaus. And here are five ways to build a payments history.

1. Start Building a Business Credit Profile Early

As a startup you should focus on establishing your business as a separate entity since inception. You can do so by getting a business phone number, professional email address, and a physical address for any correspondence (it can be your home address or a P.O. Box No). Then create a separate bank account under the name of your business.

As a new company, getting a higher range credit card may not be easy, but you can get a store-based credit line or a secured business credit card. Make sure the credit card company reports to credit bureaus. This way, you can enjoy credit card perks like cash back or rewards while building business credit through timely payments.

A new company could take at least two years to establish a business credit strong enough to get considered for a business loan from a financial institution.

2. Get a Standard Business Loan and Repay it On Time

A smart strategy to build a healthy credit profile is to take a small business loan offered by a bank, even if it is for a small amount. You may see even cash-rich companies have little debt. It is because when you repay the principal and interest amount in a timely manner, it reflects in your credit history and enhances your creditworthiness.

When making a loan application, ensure the bank reports this activity to credit bureaus. It will strengthen your credit score and will be helpful when you want a bigger business loan or funding.

3. Choose Suppliers Who Report To Various Credit Bureaus

While loan repayments add to your credit history, timely payments to your suppliers add to your payment history. Your business credit report is not only viewed by investors and banks, but even suppliers. A good credit score could help you get preferential credit or a longer payment cycle from suppliers. But not all vendors report to credit reporting bureaus.

If you are focusing on increasing business credits, choose vendors who report to major credit agencies so that your timely payments enhance your business credit.

4. Pay All Your Bills on Time

Every bill counts in building business credit. While focusing on large repayments, do not delay small payments like electricity bills, maintenance and utility bills, as it could have a negative impact on your credit score. Here’s how. Days Beyond Terms (DBT) in business credit reports. It reflects the number of days by which the payment is delayed. For example, if you pay the bill on the 31st day while the bill was due in 30 days as per terms with the vendor, your report will show 1 DBT, marking a late payment. Hence, pay bills on or before the due dates.

5. Monitor Business Credit Reports

All these efforts will only materialize into a strong business credit when it reflects in your business credit report. Unlike personal credit reports, your business credit report doesn’t report credit limits and creditor names, making it difficult to determine which companies appear on business credit reports. Hence, a good habit is to periodically monitor your report with all major credit reporting agencies for any discrepancies in the information submitted and to check the progress in credit score. You may not know who is seeing the business credit report. Hence, keep your business information updated.

A professional bookkeeper and accountant can help you stay prompt on your payments by maintaining a strong cash flow cycle of receivables and payables. The bookkeeper can help keep your accounts updated and intimate you in advance of credit needs, building a strong credit reputation for your business.

Contact McCay Duff LLP in Ottawa to Build Your Business Credit

Talk to a professional accountant and bookkeeper to help maintain accounts and inform you of future credit requirements. At McCay Duff LLP, our accountants and bookkeepers can guide you on how to build your credits. To learn more about how McCay Duff LLP can provide you with the best accounting and bookkeeping expertise, contact us online or by telephone at 613-236-2367.