The April 2021 Federal budget introduced the new Canada Recovery Hiring Program (CRHP). The program will compensate eligible employers for costs incurred to increase wages, hours worked or hiring more employees. The CRHP provides eligible employers with a subsidy of between 20 to 50 percent on the incremental wages paid to employees between June 6, 2021, and November 20, 2021.

Does your business qualify?

Employers eligible for the Canada Emergency Wage Subsidy (CEWS) would generally be eligible for the CRHP except for for-profit corporations, which must be Canadian-controlled private corporations to qualify.

Eligible employers qualify for the CRHP if they have a drop in revenue, which is to be calculated the same way as it is calculated under CEWS. Therefore, the revenue drop must be more than 0 percent for the June 6 – July 3, 2021 qualifying period. The revenue drop must be greater than 10 percent for the qualifying periods between July 4, 2021, and November 20, 2021. The revenue drop is determined under the general or alternative approach, similar to the CEWS.

The general approach compares a business’s revenue for May or June 2021 to the same month in 2019. The alternative approach compares the revenue for May or June 2021 to the average revenue from January and February 2020.

Whichever approach is chosen must be consistent with the approach used for the CEWS. If the general approach was used for the CEWS then it must be used for the CHRP and the same rule applies for the alternative approach.

Eligible employers must have a payroll account number with the Canada Revenue Agency on March 15, 2020.

How much will you receive?

This program will subsidize between 20 and 50 percent of the incremental remuneration depending on the qualifying period’s rate, subject to a maximum of $1,129 per employee per week. Non-arm’s length employees’ eligible remuneration for calculating the CHRP for a week cannot exceed their baseline remuneration for that week. Furloughed employees are not eligible for the program.

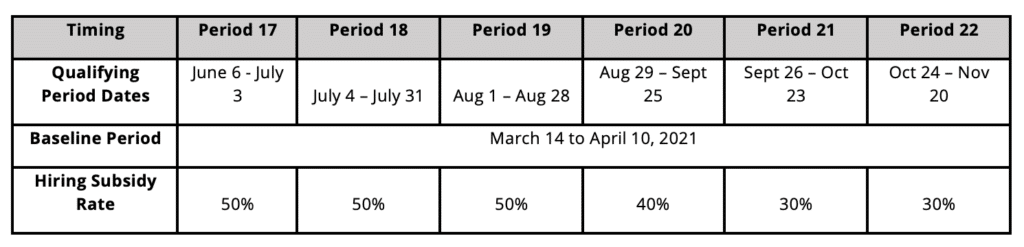

Incremental remuneration is the difference between the wages paid by the employer in a qualifying period and remuneration paid by the employer in the baseline period. The qualifying periods, baseline period and subsidy rates are as follows:

You cannot claim both the CEWS and CHRP for the same period, thus you will need to determine which is more beneficial to claim.

Similar to the CEWS, an application for a qualifying period must be filed with CRA no later than 180 days after the end of the qualifying period.

Should I hire employees?

As the subsidy rate decreases over time, there is more incentive to hire earlier on in the program to maximize the benefit from the CHRP.

However, you will want to consider if your business will have sufficient cash flow to fund the increased wages if your business is required to reduce services or close due to COVID-19 restrictions given the subsidy amount will decrease in periods 20 and 22.

Contact McCay Duff LLP in Ottawa for Straightforward and Reliable Advisory Services

Whether helping you or your company maximize wealth and minimize taxes or ensuring your not-for-profit organization meets its statutory requirements, improves accountability and reaches its own goals, the professionals at McCay Duff LLP can help.

To enjoy the benefits of having experienced business advisors on your side, contact McCay Duff LLP by reaching out online, or by telephone at 613-236-2367 or toll-free at 1-800-267-6551.