On July 17, 2020, Finance Minister Bill Morneau provided further information on the extension of the CEWS program to December 19, 2020.

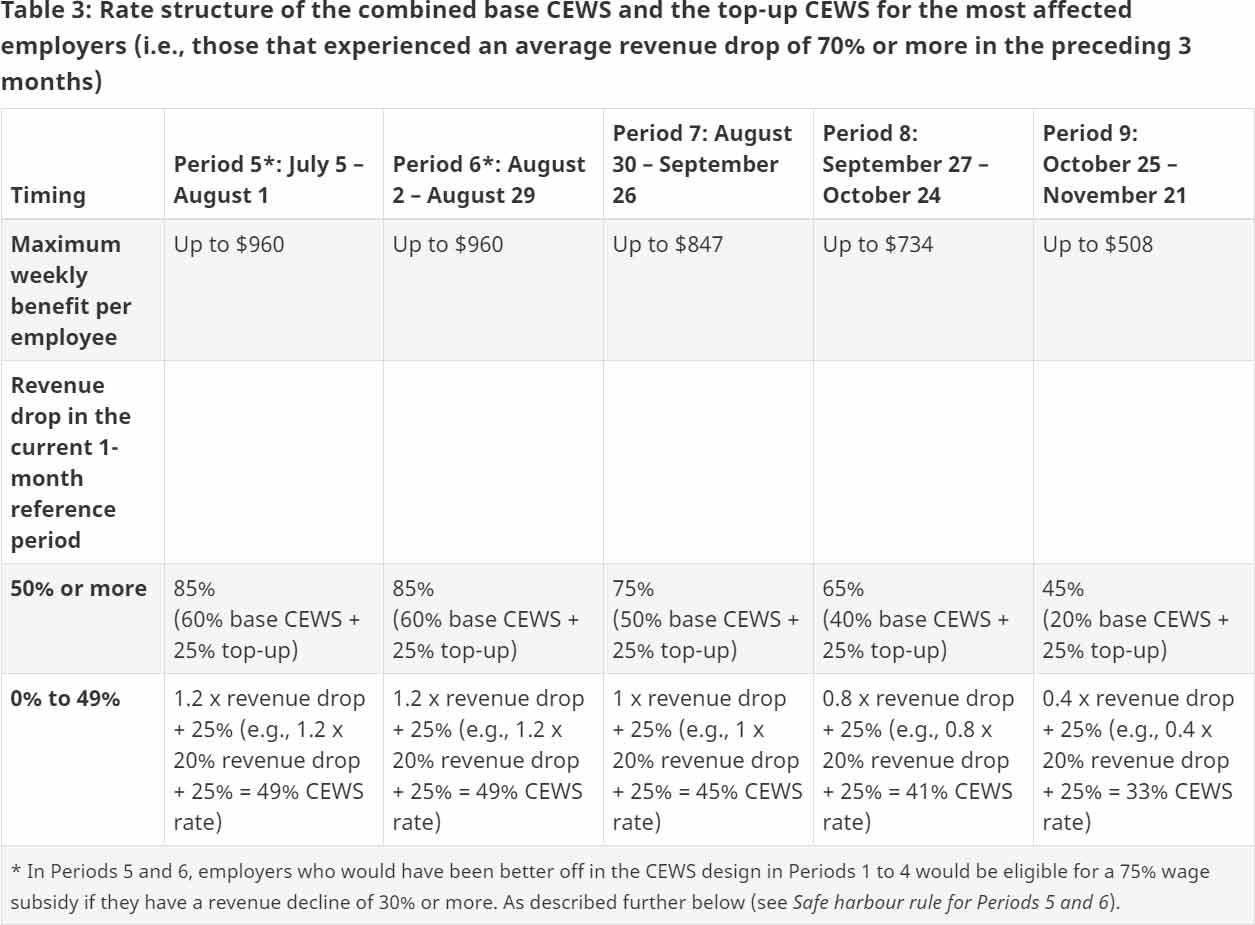

Commencing with the period beginning July 5, 2020, the 30% revenue reduction requirement will become any decline in revenue and there is an additional subsidy for those with a revenue decline greater than 50%. The maximum top-up subsidy of 25% is reached for employers with a 70% average revenue drop over the preceding three months.

Base CEWS subsidy for all employers impacted by the COVID-19 crisis

This base CEWS would be a specified rate, applied to the amount of remuneration paid to the employee for the eligibility period, on remuneration of up to $1,129 per week. The rate of the base CEWS would now vary depending on the level of revenue decline, and its application would be extended to employers with a revenue decline of less than 30 per cent (see Table 1).

The maximum base CEWS rate would be provided to employers with a revenue drop of 50% or more.

The maximum base CEWS rate would be gradually reduced from 60 per cent in Periods 5 and 6 (July 5 to August 29) to 20 per cent in Period 9 (October 25 to November 21).

Top-up CEWS subsidy for the most adversely affected employers

A top-up CEWS of up to 25 percent would be available to employers that were the most adversely impacted by the pandemic. Generally, an eligible employer’s top-up CEWS would be determined based on the revenue drop experienced when comparing revenues in the preceding 3 months to the same months in the prior year. Under the alternative approach to the calculation of baseline revenues, an eligible employer’s top-up CEWS would be determined based on the revenue drop experienced when comparing average monthly revenue in the preceding 3 months to the average monthly revenue in January and February 2020.

The top-up CEWS rate for selected average revenue drop levels is illustrated in Table 2 below.

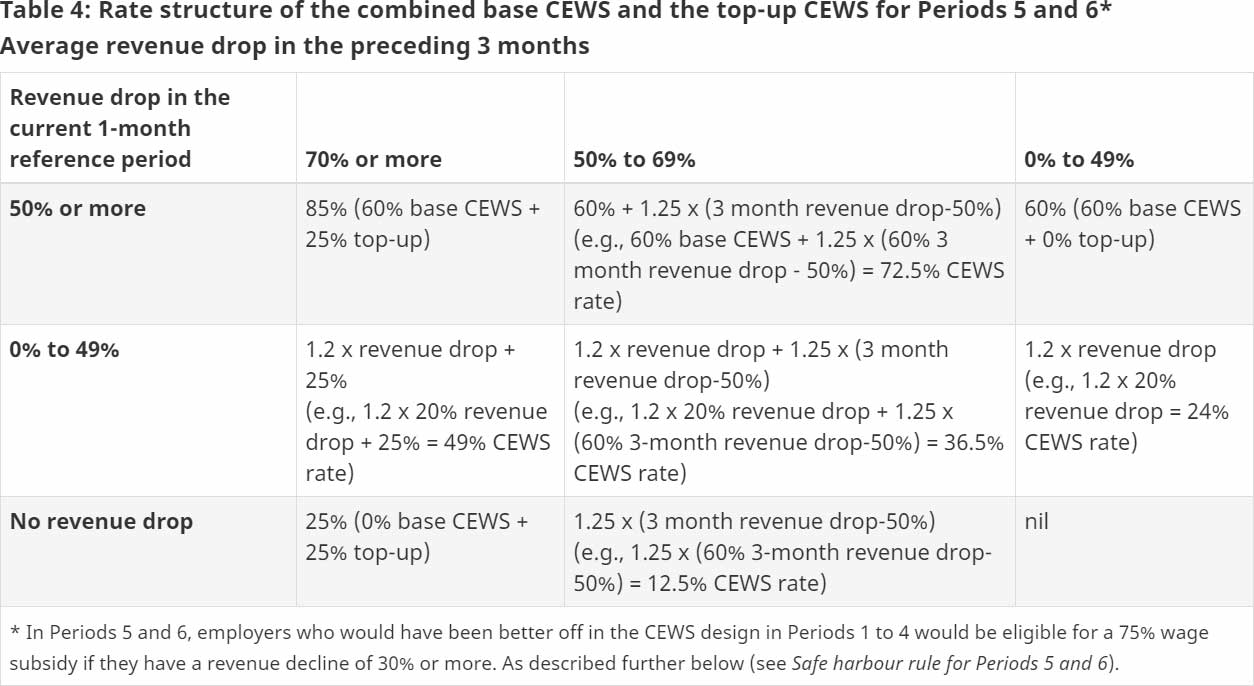

Table 4 illustrates the interaction of the 3-month drop in revenue test for the top-up CEWS and the month-over-month revenue test for the base CEWS for Periods 5 and 6. For example, an employer that is recovering with a revenue drop of 20 percent in Period 5 and a preceding 3-month average revenue drop of 60 percent would benefit from a base CEWS rate of 24 percent and a top-up CEWS rate of 12.5 percent, which would provide a combined CEWS rate of 36.5 percent.

Safe harbour rule for CEWS Periods 5 and 6

For Periods 5 and 6, an eligible employer would be entitled to a CEWS rate not lower than the rate that they would be entitled to if their entitlement were calculated under the CEWS rules that were in place for Periods 1 to 4. This means that in Periods 5 and 6, an eligible employer with a revenue decline of 30 percent or more in the relevant reference period would receive a CEWS rate of at least 75 percent or potentially an even higher CEWS rate using the new rules outlined above for the most adversely affected employers (up to 85 percent).

As the CEWS wage subsidy program continues to evolve and become more complex, rest assured that our team of professionals are working hard to keep on top of the details and are ready to assist in preparing and submitting CEWS claims. Contact your McCay Duff advisor if you would like our help!

Contact Us